- #SHOULD DUE TO DUE FROM BALANCE FULL#

- #SHOULD DUE TO DUE FROM BALANCE PLUS#

- #SHOULD DUE TO DUE FROM BALANCE PROFESSIONAL#

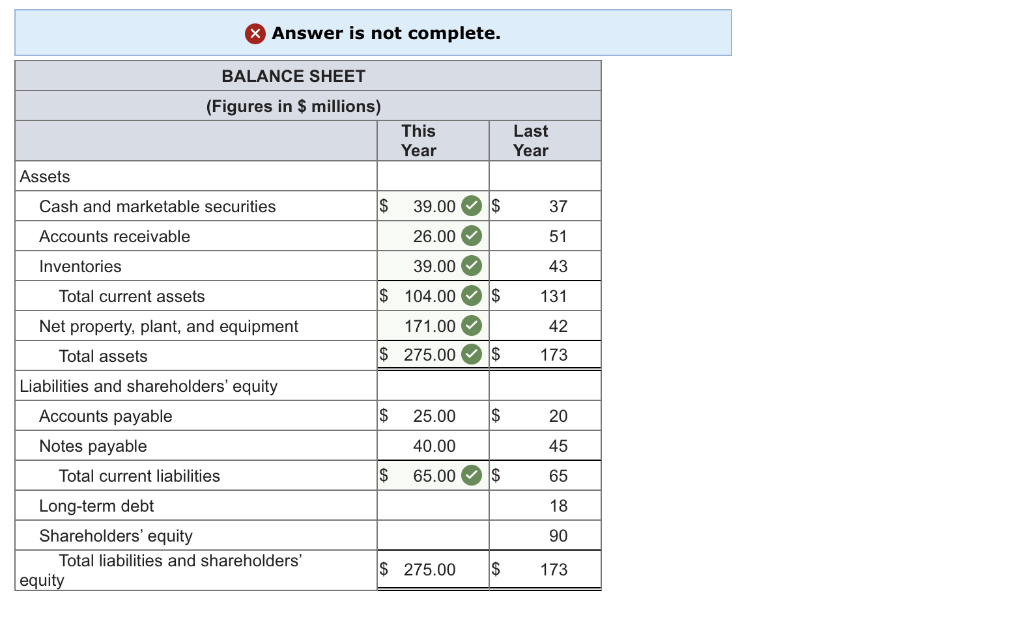

Net current assets (liabilities) Total current assets plus prepayments and accrued income less creditors: amounts due within one year. It is acceptable to show the total of short term and long term secured debts as a single figure in the creditors note. secured bank overdraft repayable on demand, instalments payable on secured loans within a year of the balance sheet etc.), they must be disclosed in the creditors note to the accounts. at any time up to a year from the balance sheet date. Creditors: amounts falling due within one yearĪmounts owed currently by the business that are payable in the short term i.e. Prepayments and accrued income Advance payments and sales that the company has not yet recorded in its books. Cash at bank and in hand The book value of the cash in hand (i.e notes and coins) and any positive current account balance at the time of the balance sheet date. Investments (Current Assets) A resource held by the company for investment rather than trading purposes, and likely to be sold soon. Debtors These are amounts owed to the business resulting from trading activity.Ī note must be provided if your debtors include any amounts due to be paid to the business more than one year from the balance sheet date. Stocks Goods bought or made for resale, but unsold as at the date of the balance sheet. Current Assets Cash or resources held for the purpose of converting into cash, these include stock, debtors and investments. Total Fixed Assets This is the total of the net book values of intangible assets, tangible assets and fixed asset investments. If fixed investments are entered a note must be provided containing details of the cost at the start of the accounting period together with any depreciation during the period. Investments (Fixed Assets) A resource held by the company for investment rather than trading purposes, e.g. If tangible assets are entered a note must be provided containing the cost at the start of the accounting period together with any depreciation during the period. company vehicles, premises, machinery and equipment. Tangible assets Long term resources, not cash or held for conversion into cash that do have a physical presence e.g. If intangible assets are entered a note must be provided containing the cost at the start of the accounting period together with any depreciation during the period. brand, reputation, goodwill, supplier relationships. Intangible assets Long term resources, not cash or held for conversion into cash that do not have a physical presence e.g. Fixed Assets Fixed assets (see below for an explanation of tangible and intangible assets) are items acquired by the business that have a value to the business and an economic life that is more extended than the accounting period for which accounts are being presented. Called up share capital not paid This is the amount that has been called for when shares have been allotted but that amount has not been received as at the date of the balance sheet. Currency You must use the same currency throughout the accounts. Otherwise an AA01 must be filed to change the company’s accounting reference date. Date of balance sheet This must be within 7 days of the accounting reference date (the date list will only display dates within this period). Comparative figures Comparative figures must be provided unless there is no prior accounting period. Additional approving director (if any) More than one director’s name can be entered if required. Approving director The name of the director who signed the company’s statutory accounts on behalf of the board of directors must be given.

Date of approving director This must be on or after the balance sheet date and must not be a date in the future (the calendar will only display dates within this period). Statements on the balance sheet All four statements must be accepted before the accounts are submitted to Companies House.

#SHOULD DUE TO DUE FROM BALANCE FULL#

General Abbreviated accounts are derived from full or simplified accounts.

#SHOULD DUE TO DUE FROM BALANCE PROFESSIONAL#

Companies House is a registry and can not provide professional accountancy advice. If you require any further technical advice regarding the content of the accounts then you will need to seek independent advice. The following guidance is provided to help you complete the abbreviated accounts for filing with Companies House.

0 kommentar(er)

0 kommentar(er)